Must Reads

Stocks

StocksETFs vs. Mutual Funds: Which is Better for Your Portfolio?

Market News

Market NewsPersonal Loan vs. Credit Card: Which is Better for Debt Consolidation?

Finance

FinanceSwing Trading vs. Scalping: Which Strategy Works Best?

Stocks

StocksHow can I develop a millionaire mindset?

Stocks

StocksHow to Choose the Right Mutual Fund for Your Financial Goals

Stocks

Stocks5 Secret Credit Card Tricks Banks Don’t Want You to Know

Finance

FinanceHow Economic Trends Affect Personal Finances and Investments

Finance

FinanceEstate Planning: Securing Your Assets for the Next Generation

The Role of Financial Advisors in Wealth Management

Financial advisors play a critical role in wealth management by helping individuals and families make informed decisions about their money, investments, and long-term financial goals. Whether you're looking to build wealth, plan for retirement, or navigate complex financial decisions, financial advisors bring expertise and a personalized approach to managing your finances.

The Basics of Passive Income: How to Make Money Work for You

Passive income is a powerful financial strategy that allows you to earn money with little ongoing effort. Unlike active income, where you exchange time for money, passive income continues to flow even when you’re not actively working. Whether you’re looking to supplement your current income or build a full-fledged passive income stream, understanding the basics is key. In this article, we’ll explore what passive income is, why it’s beneficial, and how you can start creating your own streams of passive income.

Financial Mistakes to Avoid in Your 20s, 30s, and 40s

Managing your finances wisely is crucial at every stage of life. Each decade comes with unique financial challenges, and making the wrong moves can impact your future. In this article, we’ll explore common financial mistakes to avoid in your 20s, 30s, and 40s to set yourself up for financial success.

What are the daily habits of wealthy people?

Wealthy people tend to follow daily habits that optimize their health, mindset, productivity, and finances. From consistent reading and exercise to disciplined money management, networking, and mindful goal-setting, these routines shape long-term success. While wealth accumulation depends on strategy and opportunity, daily choices create the foundation for sustainable prosperity.

Best Day Trading Strategies for the U.S. Stock Market

Day trading in the U.S. stock market requires strategy, discipline, and a solid understanding of market trends. Successful traders rely on effective techniques to maximize profits while managing risks in a fast-paced environment.

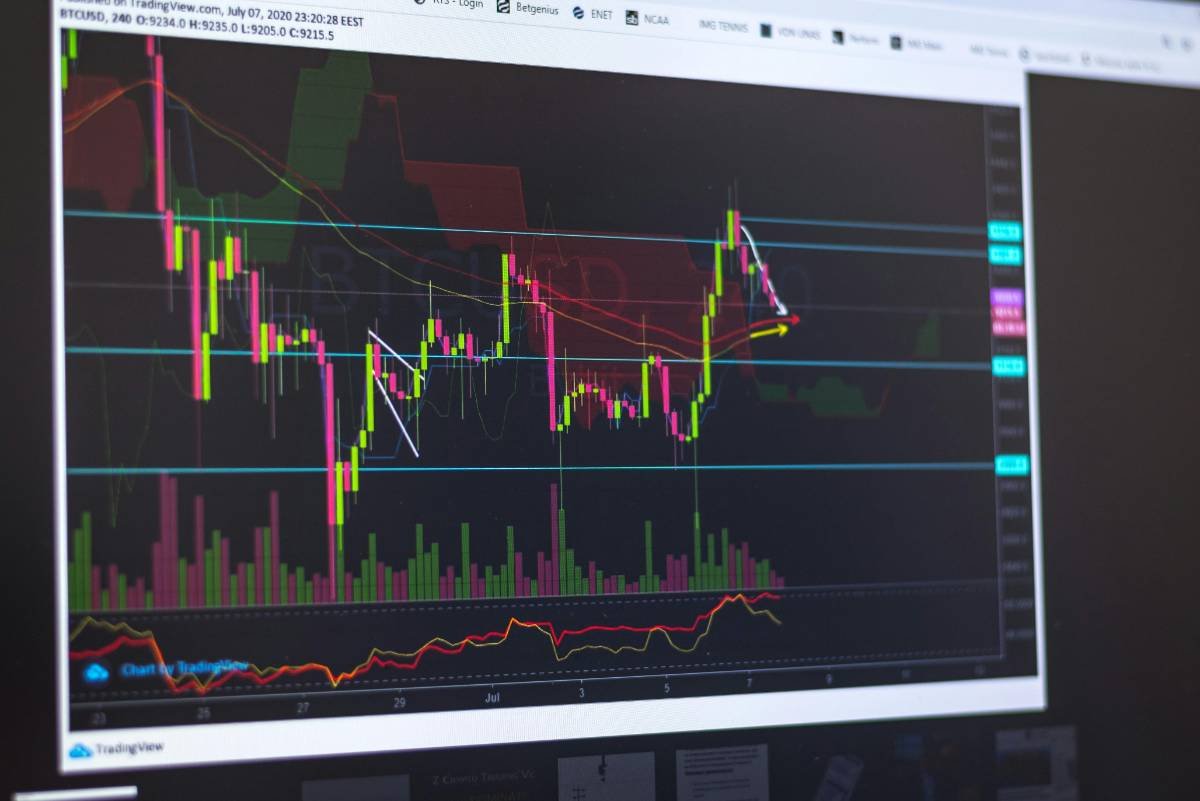

How to Use Technical Analysis for Profitable Trades

Technical analysis is a powerful tool for traders looking to identify profitable opportunities in the stock market. By analyzing price movements and patterns, traders can make informed decisions based on historical data.

How to Build a Diversified Portfolio Using ETFs and Mutual Funds

Building a diversified portfolio is essential for managing risk and maximizing returns. Using a combination of ETFs and mutual funds can help investors achieve balance and long-term growth in their investments.

![Is [Specific Stock] a Good Buy Right Now?](/articles/stockwealth203.jpg)

Is [Specific Stock] a Good Buy Right Now?

A nuanced and deeply researched guide answering “Is [specific stock] a good buy right now?”—offering clarity through expert-backed data, real-life examples, and investor-oriented FAQs. Emphasizing practical insights, emotional resonance, and trustworthiness, this long-form article aids readers in confidently navigating current market conditions, balancing short-term signals with long-term wealth-building strategies.

5 Key Differences Between Personal and Business Loans

Understanding the differences between personal and business loans is essential for choosing the right financing option. Here are five key distinctions to keep in mind.

Understanding Credit Scores: How to Improve Yours

Your credit score plays a crucial role in financial health, affecting loan approvals, interest rates, and even job opportunities. Understanding how credit scores work and how to improve them can lead to better financial stability.

How to Choose the Right Mutual Fund for Your Financial Goals

Mutual funds offer investors a diversified way to grow wealth, but choosing the right one depends on individual financial goals. Understanding different fund types and risk levels is key to making an informed decision.

Top Gainers and Losers on Wall Street This Month

The stock market is constantly shifting, with certain stocks outperforming while others struggle. This month, Wall Street has seen significant movements in both directions. Here’s a look at the top gainers and losers.

Swing Trading vs. Scalping: Which Strategy Works Best?

Choosing between swing trading and scalping depends on an investor's risk tolerance, time commitment, and trading style. Each strategy has its advantages and challenges, making it essential to understand how they work before deciding which suits you best.

How to Build and Improve Your Credit Score

Building and improving your credit score is essential for securing favorable loan terms, lower interest rates, and better financial opportunities. A good credit score can also help you in securing jobs and housing. Here's a guide on how to improve and maintain your credit score for a healthier financial future.

A Complete Guide to Choosing the Right Insurance Policy for Your Needs

Choosing the right insurance policy can be challenging, but it’s essential for financial security. From health and life to auto and home insurance, this guide will help you understand what to consider.

Understanding the US Banking System: How It Works and Why It Matters

The US banking system is a cornerstone of the country's economy, affecting every aspect of financial life. This guide explains how it works and its importance for consumers.

Top Financial Planning Tips for 2024

As we head into 2024, financial planning remains as crucial as ever. Whether you’re looking to boost savings, make smart investments, or prepare for retirement, having a solid financial plan is essential. Here are some practical tips to help you navigate the financial landscape in the year ahead.

Tech Stocks to Watch: Are We in Another Boom?

The technology sector has been a driving force in the stock market, and recent trends suggest another potential boom. With advancements in artificial intelligence, cloud computing, and semiconductor innovation, investors are eyeing key tech stocks for future growth.

What are the safest investment options in 2025?

In 2025, the safest investment options blend capital protection with modest returns—from FDIC-insured high-yield savings, CDs, and Treasury securities to I-Bonds, stable value funds, TIPS, low-risk annuities, and gold as a modern safe-haven. This guide explores each option with practical examples, FAQs, and expert-backed data to help you make informed choices.

Car Insurance in the US: What You Need to Know Before You Buy

Buying car insurance in the US can be confusing, especially with so many options. Here’s what you need to know before making a purchase decision.