Finance

How do I interpret market indices like NIFTY and SENSEX?

Market indices like NIFTY and SENSEX act as the barometers of the Indian economy. They help investors, traders, and policymakers gauge overall market sentiment and corporate performance. Interpreting these indices involves understanding their calculation, movements, global influences, and practical applications in investing. This comprehensive guide breaks down NIFTY and SENSEX with real-life examples, FAQs, and actionable insights for anyone looking to decode the stock market.

By Anita Singh

By Anita Singh8 min read

What is the current trend in the stock market?

Across August 2025, U.S. equities continue a robust upward trajectory, with major indices—S&P 500, Nasdaq, and Dow—all hitting fresh all-time highs amid easing inflation and growing odds of a Federal Reserve rate cut. While megacap tech and AI sectors lead gains, analysts highlight growing interest in small/mid-caps, even as caution builds over valuation and prolonged volatility.

By Anita Singh

By Anita Singh12 min read

Pre-Market and After-Hours Trading: Opportunities and Risks

Pre-market and after-hours trading extend beyond standard market hours, offering traders additional opportunities. However, these sessions come with unique risks and challenges that investors should understand.

By Anita Singh

By Anita Singh3 min read

Algorithmic Trading: How AI Is Changing the Stock Market

Algorithmic trading, also known as algo trading, leverages AI and machine learning to execute trades with high speed and precision. This technology is reshaping the financial markets by minimizing human error and maximizing efficiency.

By Samantha Lee

By Samantha Lee3 min read

The Psychology of Trading: How to Manage Emotions and Stay

Emotions play a significant role in trading, often leading to impulsive decisions and costly mistakes. Understanding the psychology behind trading can help investors stay disciplined and make rational choices.

By Rajat Sen

By Rajat Sen4 min read

How to Use Fibonacci Retracements in Trading Journey

Fibonacci retracements are a popular technical analysis tool used by traders to identify potential support and resistance levels in the market. Understanding how to apply Fibonacci levels can enhance trading strategies and improve decision-making.

By James Carter

By James Carter3 min read

Options Trading Strategies: Calls, Puts, and Spreads Explained

Options trading is a powerful financial tool that allows traders to speculate on asset price movements, hedge risk, and enhance portfolio returns. Understanding how calls, puts, and spreads work is essential for success in the options market.

By Rahul Sharma

By Rahul Sharma5 min read

Swing Trading Strategies That Work in the U.S. Market

Swing trading is a strategy that focuses on capturing short- to medium-term price movements within a trend. Traders use this approach to profit from price fluctuations by holding positions for days or weeks rather than minutes or hours.

By Anita Singh

By Anita Singh5 min read

Momentum Trading: How to Ride Trends for Maximum Gains

Momentum trading is a strategy that focuses on capitalizing on strong price trends. Traders use this approach to ride market movements and maximize gains by entering positions that align with prevailing momentum.

By James Carter

By James Carter5 min read

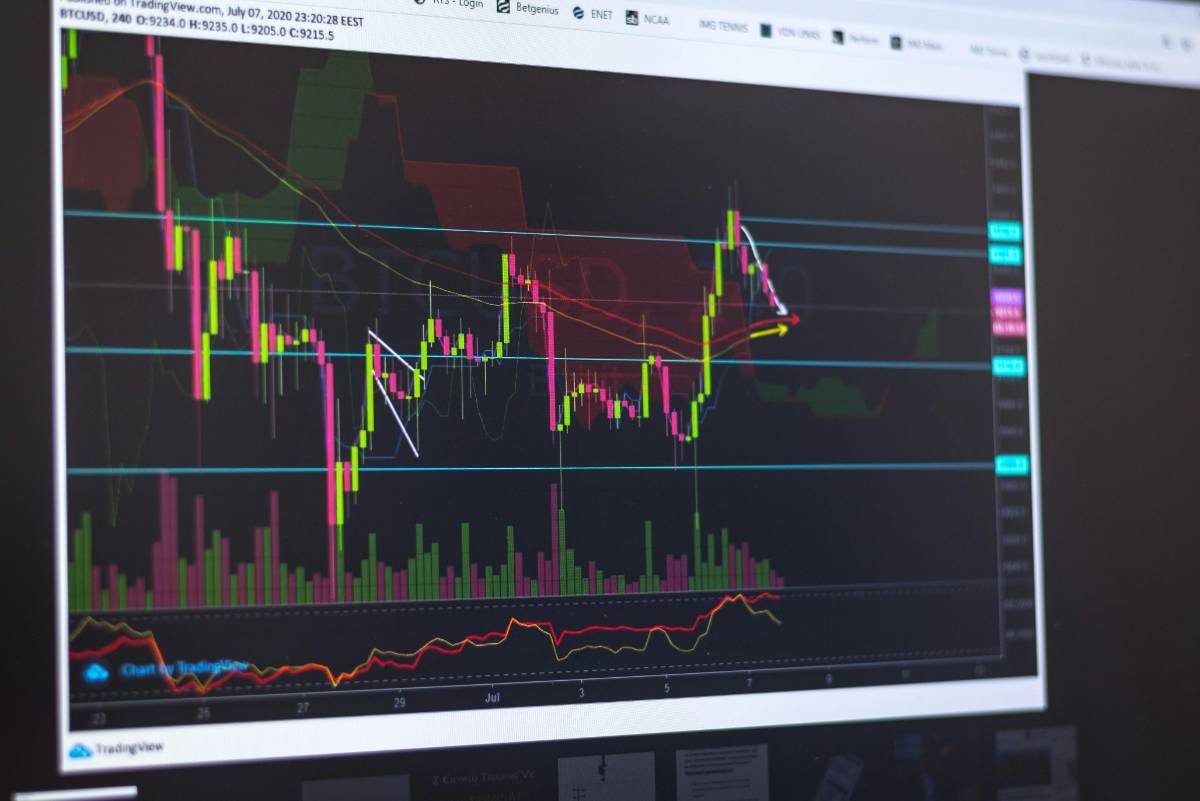

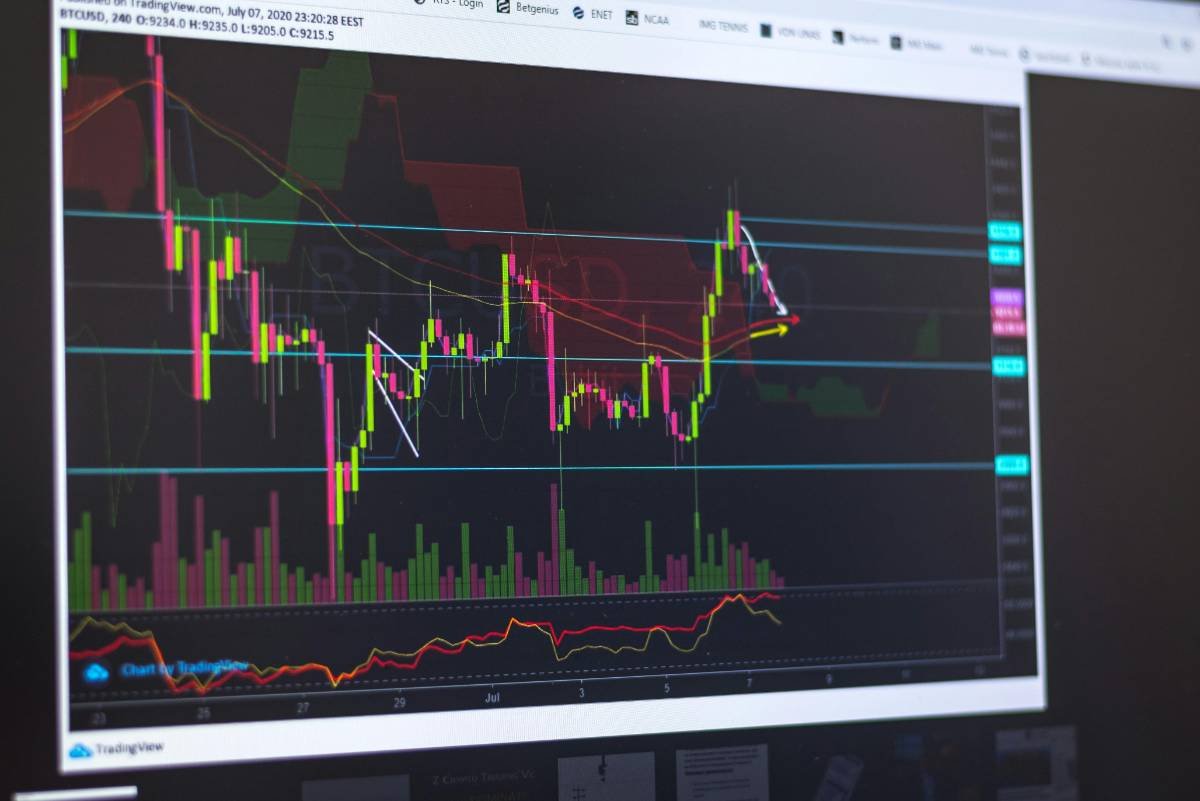

The Role of Technical Indicators in Successful Trading

Technical indicators play a crucial role in helping traders analyze market trends, identify opportunities, and make informed trading decisions. By leveraging these tools, traders can improve their chances of success in the financial markets.

By Rajat Sen

By Rajat Sen4 min read

How to Profit from Market Volatility: A Trader’s Guide

Market volatility can create both risks and opportunities for traders. Understanding how to navigate price swings effectively can lead to profitable trades and long-term success.

By Samantha Lee

By Samantha Lee3 min read

Best Trading Strategies for Beginners in the U.S. Stock Market

Navigating the stock market as a beginner can be overwhelming, but with the right strategies, new investors can build confidence and success over time.

By Anita Singh

By Anita Singh5 min read

Risk Management Strategies for U.S. Traders

Risk management is crucial for traders aiming to protect their capital and achieve long-term success in the U.S. financial markets. Implementing proper risk management strategies helps mitigate losses and maximize profits effectively.

By Rahul Sharma

By Rahul Sharma3 min read

How to Use Technical Analysis for Profitable Trades

Technical analysis is a powerful tool for traders looking to identify profitable opportunities in the stock market. By analyzing price movements and patterns, traders can make informed decisions based on historical data.

By James Carter

By James Carter5 min read

Options Trading in the USA: A Beginner’s Guide

Options trading in the USA provides investors with the flexibility to hedge risk, generate income, or speculate on price movements. Understanding the basics of options can help beginners make informed trading decisions.

By Rajat Sen

By Rajat Sen3 min read

Swing Trading vs. Scalping: Which Strategy Works Best?

Choosing between swing trading and scalping depends on an investor's risk tolerance, time commitment, and trading style. Each strategy has its advantages and challenges, making it essential to understand how they work before deciding which suits you best.

By Anita Singh

By Anita Singh4 min read

Best Day Trading Strategies for the U.S. Stock Market

Day trading in the U.S. stock market requires strategy, discipline, and a solid understanding of market trends. Successful traders rely on effective techniques to maximize profits while managing risks in a fast-paced environment.

By Samantha Lee

By Samantha Lee5 min read

How Economic Trends Affect Personal Finances and Investments

Economic trends play a crucial role in shaping personal finances and investments. Whether it's the state of the economy, inflation rates, or interest rates, economic trends influence how individuals manage their money, invest in stocks, bonds, and real estate, and plan for retirement. Understanding these trends is vital to making informed financial decisions. In this article, we’ll explore how various economic trends impact personal finances and investments.

By James Carter

By James Carter3 min read

The Pros and Cons of Investing in Gold and Precious Metals

Investing in gold and precious metals has long been considered a safe haven, especially during periods of economic uncertainty. Precious metals such as gold, silver, platinum, and palladium have a history of retaining their value and even appreciating during times of market volatility. However, like any investment, they come with their own set of pros and cons. In this article, we’ll explore the advantages and disadvantages of investing in gold and other precious metals.

By Samantha Lee

By Samantha Lee4 min read

The Pros and Cons of Investing in Gold and Precious Metals

Investing in gold and precious metals has long been considered a safe haven, especially during periods of economic uncertainty. Precious metals such as gold, silver, platinum, and palladium have a history of retaining their value and even appreciating during times of market volatility. However, like any investment, they come with their own set of pros and cons. In this article, we’ll explore the advantages and disadvantages of investing in gold and other precious metals.

By Anita Singh

By Anita Singh3 min read