How to Build Wealth in America: Smart Financial Strategies

By Rajat Sen

By Rajat SenBuilding wealth in America requires a combination of smart financial planning, disciplined saving, and strategic investing. By understanding key principles, individuals can create long-term financial stability and success.

Develop a Budget and Save

A well-structured budget is the foundation of wealth building. Tracking income and expenses helps in identifying saving opportunities and reducing unnecessary spending.

Consistently saving a portion of income and building an emergency fund ensures financial security during unexpected situations.

Invest for Growth

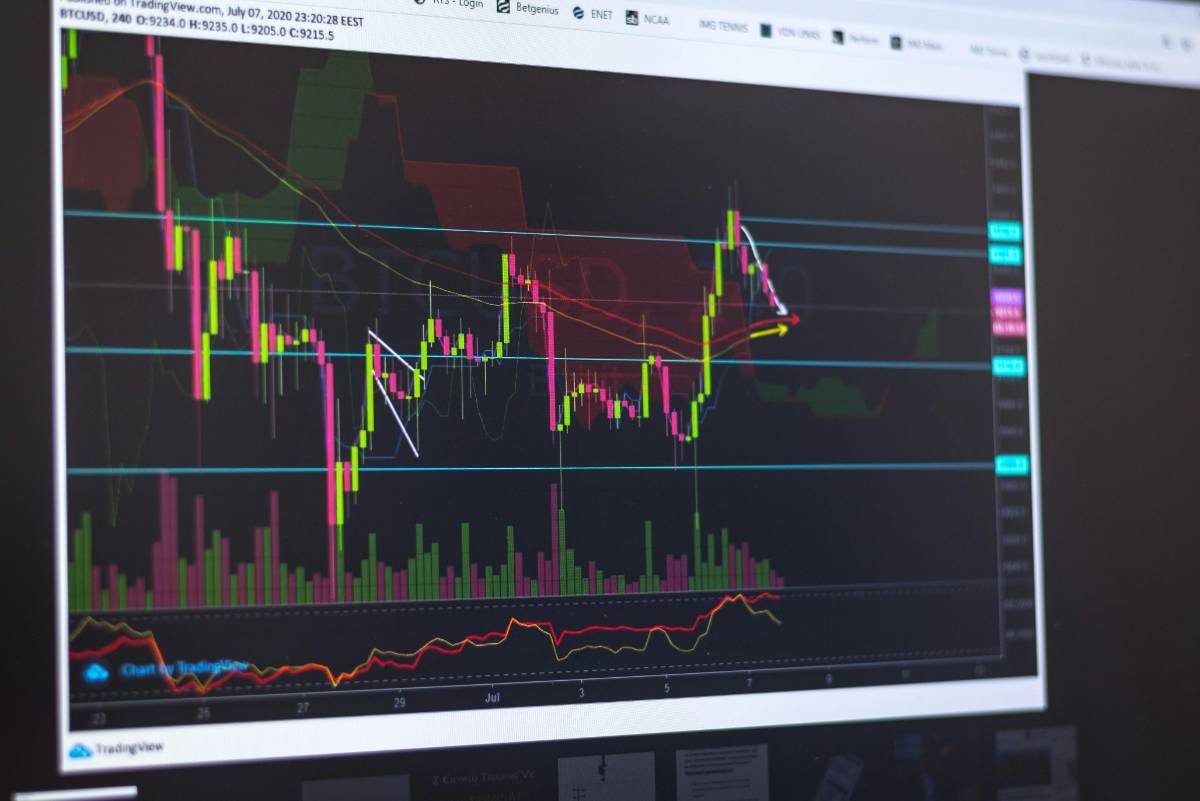

Investing is a crucial step in wealth accumulation. Stocks, real estate, and retirement accounts like 401(k)s and IRAs offer opportunities for long-term financial growth.

Diversifying investments and understanding market trends help mitigate risks and maximize returns over time.

Minimize Debt and Build Credit

Managing debt effectively is key to financial success. Paying off high-interest debt, such as credit cards, frees up money for savings and investments.

Building a strong credit score also opens doors to better financial opportunities, including lower interest rates on loans and mortgages.

Increase Income and Build Multiple Streams

Growing wealth isn’t just about saving—it’s also about increasing income. Advancing in a career, starting a side hustle, or investing in passive income sources can accelerate financial growth.

Exploring multiple income streams reduces reliance on a single source and enhances financial security.

Conclusion

Wealth building in America is a long-term process that requires smart planning and discipline. By budgeting, investing wisely, managing debt, and increasing income streams, individuals can achieve financial freedom and long-term prosperity.